Health and Travel Insurance for Digital Nomads

As a digital nomad, health and travel insurance are essential to ensure peace of mind while working and traveling across the globe. Here’s a guide to help you choose the right insurance and manage potential risks:

Why Insurance is Important for Digital Nomads?

- Health Protection: Covers medical emergencies, doctor visits, and even chronic condition management.

- Travel Coverage: Protects against trip cancellations, lost baggage, or delayed flights.

- Flexibility: Offers global coverage suitable for frequent travelers and remote workers.

- Legal and Visa Requirements: Some countries require proof of insurance for long-term visas or work permits.

Key Features to Look For in Nomad Insurance

- Global Coverage: Ensure it covers multiple countries, including your home country.

- Medical Expenses: Coverage for hospitalization, emergency care, and outpatient visits.

- Evacuation and Repatriation: Covers emergency evacuation or transport back home in case of severe illness or injury.

- Adventure Activities: If you plan to engage in trekking, diving, or other risky activities, ensure they’re included.

- Travel Benefits: Coverage for flight delays, trip interruptions, and lost belongings.

- Telehealth Options: Access to virtual consultations for minor health issues.

- Customizable Plans: Choose a plan that fits your travel habits and budget.

Top Insurance Providers for Digital Nomads

- SafetyWing: Affordable, flexible plans with global health and travel insurance designed specifically for nomads.

- World Nomads: Excellent for adventurous travelers with coverage for various activities.

- Cigna Global: Comprehensive international health insurance with customizable plans.

- Allianz Travel Insurance: Strong reputation for reliable travel insurance, ideal for long-term travelers.

- Integra Global: Focuses on health insurance with extensive global networks.

- IMG Global: Offers travel and health insurance plans with a wide range of coverage options.

Tips for Choosing the Best Plan

- Assess Your Needs: Consider your travel destinations, health conditions, and lifestyle.

- Compare Plans: Use comparison tools or brokers to evaluate multiple policies.

- Read the Fine Print: Understand exclusions, limitations, and coverage caps.

- Check Reviews: Look for feedback from other nomads to ensure the provider’s reliability.

- Start Early: Purchase insurance before starting your trip to avoid gaps in coverage.

Additional Considerations

- Local Insurance: If you’re staying long-term in one country, local insurance might be more affordable.

- Emergency Fund: Keep a reserve for minor medical expenses not covered by insurance.

- Tax Implications: Some plans may have tax advantages depending on your home country.

With proper health and travel insurance, you can focus on exploring new places and embracing your digital nomad lifestyle without unnecessary worries. 🌍💻

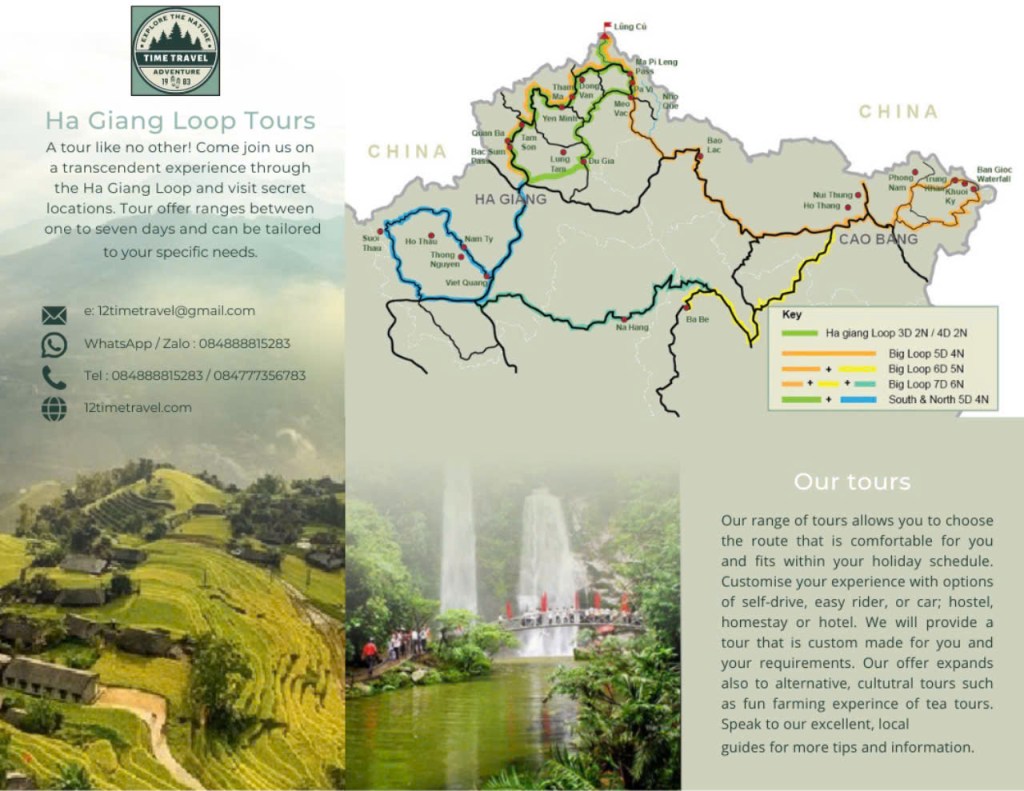

time trvel Tour

Navigating life’s intricate fabric, choices unfold paths to the extraordinary, demanding creativity, curiosity, and courage for a truly fulfilling journey.

Contact

68 Phung Hung, Tran Phu, Ha Giang city, Ha Giang province

12timetravel@gmail.com

+84 978898178

+84 888815283

Leave a comment